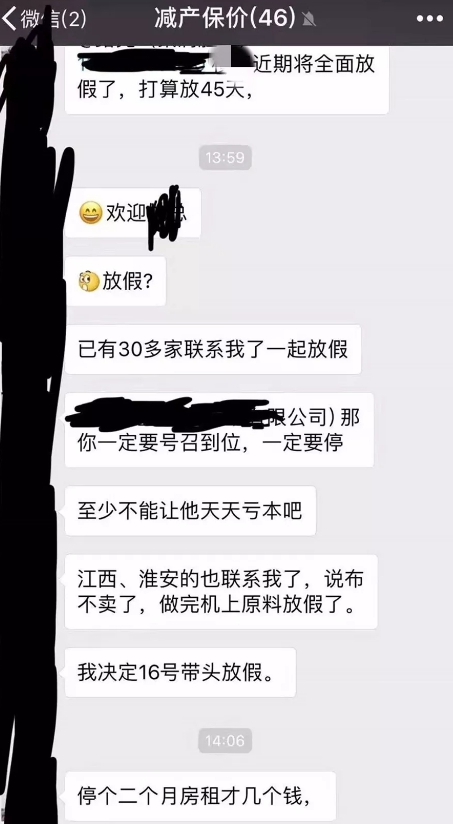

At the beginning of July, news spread in the circle of friends that weaving manufacturers were planning to form a group to limit production and protect prices. They were preparing to take a holiday after finishing the raw materials for machine use.

In mid-to-late July, another high temperature holiday notice circulated on the market!

Textile people have said that the high temperature is not a reason. If business is good, why would the boss be willing to take a holiday? ! This July, weaving mills have been struggling between stopping and not stopping. Is this an exception or a commonality in the market? To this end, the China Silk City Network’s Acquisition and Editing Center went deep into the market to investigate the current situation of the textile market.

The order-taking situation since July has been unsatisfactory

In June, I hoped that the market would get better, but In July, the situation seems to be unsatisfactory. Manager Wu of Runtu Textile Co., Ltd. said that we mainly focus on women’s clothing fabrics. The market orders in July were average, with a big year-on-year gap. Suzhou Runsili Textile mainly sells various types of Oxford cloth. Manager Xu of the company also said that the order situation in July was not good, with a drop of 20%-30% compared with previous years. Similarly, Manager Xu of Chenlong Xinsheng also revealed that our main products are nylon spinning, pongee, polyester taffeta, etc. We have orders in July, but we can only make it this month. Last year, the orders It’s scheduled until October.

So, when the market is cold and orders are missing, will weaving factories choose to reduce production?

The operating rate is linked to orders, gray cloth inventory, and funds

Suzhou Pulin Manager Shao of Si Textile and Manager Yu of Wujiang Baixiang Inkjet Weaving both said that there will be no operation to reduce the operating hours. Manager Shao said that even if the market is not good, we will not reduce the operating hours. They are all trying to hold on. Some manufacturers also expressed that they may have plans to reduce their operating hours in the future. Manager Wang from Hengxin Weaving said that currently 200 water-jet looms in our factory are fully operational, and 160 air-jet looms have stopped by one-third. The operating rate is still the same as the previous one. Orders are linked, more orders will be opened, and fewer orders will be opened. Mr. Meng of Mingpeng Knitting also said that the 26 circular knitting machines in their factory are currently operating at 70-80% capacity. Whether the operation will be reduced next depends on the order situation. Manager Wu of Runtu Textile also revealed that the current operating rate of the manufacturers we have contacted is around 70%. Under the pressure of gray fabric inventory and capital, manufacturers will consider reducing their operating hours.

There are also operations to reduce construction and sell goods in peripheral areas

It is understood that the production capacity of emerging water-jet looms transferred to northern Jiangsu, Anhui, Hubei, Jiangxi and other places in the past two years has exceeded the 200,000-unit mark, far from It exceeds the number of water-jet looms eliminated by traditional textile clusters in the Yangtze River Delta region. Gray fabric production capacity is in a state of blowout!

Recently, I heard that many peripheral loom manufacturers have also begun to reduce production. Tomorrow Mr. Meng of Peng Knitting revealed to the editor that he heard that the inventory in northern Jiangsu is relatively high, and there are operations to reduce operating hours and production. Manager Xu of Chenlong Xinsheng also said that peripheral weaving factories have the operation of dumping goods. If the goods cannot be thrown away, they will start to reduce production. After all, the reduction in production is also to relieve inventory pressure. It is reported that the inventory of textile enterprises in northern Jiangsu and central and western regions is generally about 2 months. Cloth cannot be sold, and inventory is getting higher and higher. Production reduction and holidays are also helpless actions.

Will the market get better?

As for the market trend in the second half of the year, most bosses said that generally speaking, it will be better in September and October, but it is not expected to be much better this year. go. Chenlong’s newly promoted manager Xu said that the global economy has declined this year, and market demand has also declined. The poor market trend this year is a cyclical nature of the economy. Last year, it was too good all of a sudden, and there were signs of false prosperity. Last year, there were many increases. Producing factories may be clearing last year’s inventory this year. Manager Wang of Hengxin Weaving also expressed that he is not optimistic about the market outlook: “Golden Nine and Silver Ten” actually have little impact on us. Our products are relatively niche and our customer base is relatively fixed. There will not be big fluctuations. Now peripheral production capacity has increased. It will definitely squeeze Shengze’s local weaving industry. Coupled with the lack of orders in the entire market, it is difficult to see an improvement trend in the future.

At present, there is a strong pessimism in the market. As Mr. Meng of Mingpeng Knitting said, this year we will mainly ensure that we can operate normally in this industry without considering profits. As high as you can, as long as you can survive. Perhaps this is also the sentiment of many cloth bosses. They don’t ask for how much money they can make, but just want to be able to survive!

</p